The Media CEO’s Playbook: Winning During the Disruptive Technology Revolution

The Media CEO’s Playbook: Winning During the Disruptive Technology Revolution

Antonio Guastafierro Senior Managing Director

Melissa Maduri Senior Director

Julian Boerner Senior Director

Over the past 25 years, the global media industry has undergone a digital paradigm shift that has fundamentally transformed how it operates and has generated significant value. Although some legacy media companies managed to adapt, many did not, and new market entrants absorbed the majority of the value generated. Today, we are on the precipice of the next paradigm shift, driven by disruptive technologies such as artificial intelligence (“AI”), immersive and blockchain. Massive value is sure to be created again, but the question remains: Who will be in a position to benefit? Facing high degrees of uncertainty with regard to the impact of these disruptive technologies, incumbents appear to be poised to repeat the mistakes of the past.

This paper details key learnings from the digital paradigm shift of the past, our perspective on disruptive technologies, and the approaches taken by today’s media executives. It concludes with guiding principles and tactical next steps to help executives avoid the mistakes of the past. This paper is based on recent and past interview programs with executives on how they addressed the challenges and opportunities of the digital paradigm shift of the past and intend to approach the disruptive technology-driven paradigm shift of the future. Our interviews included executives from companies of various sizes and market positions, including traditional media companies (e.g., Warner Media, NBC, the New York Times) to digital-native companies (e.g., Amazon, Apple) and companies from other sectors (e.g., Aptiv, HighRadius, Siemens).

Key takeaways include:

The innovation made possible by disruptive technologies such as AI, immersive and blockchain will generate significant value and affect media business models over the next decade.

Capitalizing on the value generated by the application of these disruptive technologies will involve not just a clear-eyed strategy but, more importantly, an examination of operating model setups.

CEOs will need to understand the implications of the next paradigm shift, determine the impact on the firm, understand which operating model setups will enable them to drive change, and evangelize for it top-down while also aligning with executive teams and boards.

Adapting to the next paradigm shift will require funding, resources and attention, with executives stepping up to lead long-term innovation and ensure effective change.

Part I: Digital Paradigm Shift of the Past

25 Years of Change

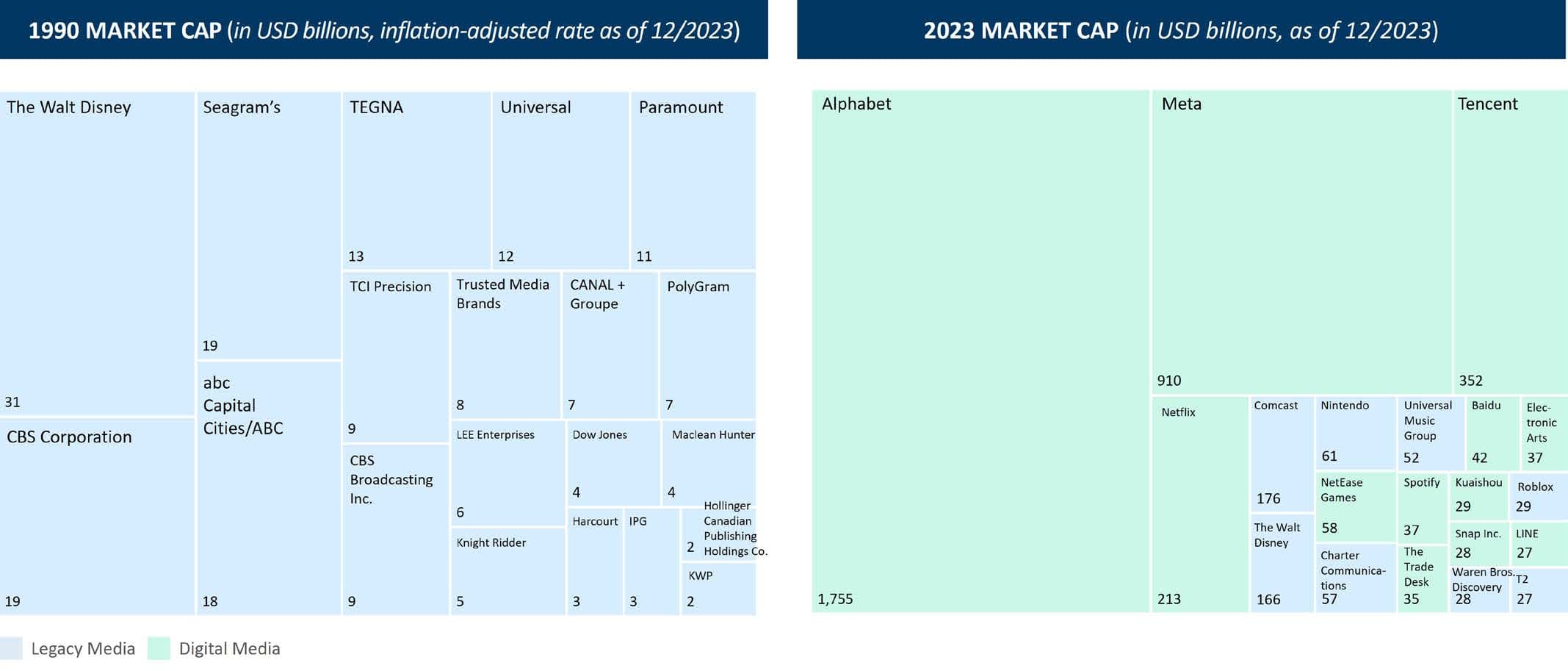

The turbulent transition from traditional to digital media in the last quarter-century represented a paradigm shift in the global media ecosystem. This shift produced successful transitions among the old media elite, like the New York Times, and less successful transitions, such as for Kodak and Blockbuster. It also allowed new entrants into the market like Meta, Alphabet and Spotify. Today, there is no question that massive value was created in the media ecosystem during that transition. In the past 25 years alone, the contribution of digital products and services to the global media and entertainment (“M&E”) market has soared by more than $1.5 trillion. It is projected to reach $1.9 trillion by 2027, accounting for 71% of the M&E market.1

However, there was much trial and error. New market entrants absorbed around 86% of the value created, while the remainder was distributed among other participants.2

EXHIBIT 1: TOP 20 MEDIA & ENTERTAINMENT COMPANIES BY ENTERPRISE VALUE (“EV”), 1990 AND 2023

Now we are on the precipice of the next paradigm shift. This time, disruptive technologies like artificial intelligence, immersive and blockchain will drive the shift. Massive value will be created — but who will benefit?

Many firms continue to struggle with organizing themselves in a way to concurrently exploit their legacy core business that contributes most of the revenue and profit while exploring a new, potential core business that will start as a cost center but will ultimately become dominant. The good news is that, by analyzing the last paradigm shift, they can learn how to manage the next one. The last 25 years of digital strategy and transformation work boil down to eight key learnings:

The digital disruption largely transformed the core value proposition of many media firms.

The business model of most media firms changed dramatically, and legacy models were not sustainable.

Most early digital strategies failed to deliver against expectations; firms that had a smart setup and approach to digital strategy outperformed.

The inevitable shift to digital media did not favor all media segments; the only way for firms in these segments to win the game was to avoid it and maximize profitability in the short- to medium-term.

Successful engagement with the new digital core business required an ambidextrous approach (see Part III); the inertia of the existing business made it difficult to exploit the current landscape while also exploring a new one.

Companies with the healthiest legacy core business were at the strongest starting point, but also had the most difficulty fostering ambidexterity to drive the necessary changes. New technologies gave rise to the need for new in-house capabilities.

New technologies gave rise to the need for new inhouse capabilities.

Engaging appropriately with this digital paradigm shift in media required the involvement of CEOs.

A Fundamental Trap

Management and strategy failures certainly played a role in the underperformance of many legacy media businesses. One of the most prominent, yet common, managerial blunders was assuming that traditional media companies would move quickly and effectively once digital media became profitable. This turned out to be a fundamental trap.

For many businesses that adopted this approach, it was too late to easily gain market share once digital media became profitable. (A recent example of this is the slowed pace of legacy studios in defining and developing a strategic response to the rise of Netflix and over-the-top distribution.) There were two root causes for this.

First, during the digital paradigm shift, the lack of revenues, and especially profits, of new market entrants that were in the process of developing a new value proposition was often used by media executives as justification to maintain a focus on the legacy business, at the expense of moving on the new opportunities provided by the digital paradigm shift. This phenomenon continues today: new market entrants still often lose money. However, by the time a new media business becomes profitable, it is almost impossible for a legacy company to quickly compete with them and achieve the new, hard-to-acquire capabilities that they have.

Second, and more significant, was that the structures of the legacy businesses (e.g., its organization, operating model and governance) were unsuited to reacting to the change playing out in front of everybody’s eyes — let alone support a business competing in the new paradigm — even if the executive at the helm of the organization grasped the magnitude of the ongoing changes. As one senior executive for a global media conglomerate recalled:

“We had done multiple studies with renowned consulting firms about how digital would impact our firm, and the executive team believed them. We understood the significance of the changes in the ecosystem, but it was almost impossible to shift our organization enough to respond appropriately. Some days, it felt like I was the driver of a locomotive, steaming towards an obstacle that only I could see, and I was slamming my fists against the unbreakable glass over the emergency brake.”

There are two aspects to managing such a paradigm shift. The first is the understanding of the matter, and then there is the action that is necessary to take in response. The latter proved to be the most significant roadblock to success for legacy media organizations.

Although most of them came to understand the significance of ongoing changes, their structures made it impossible for them to appropriately engage with the new paradigm.

EXHIBIT 2: COMPARING PERCEPTIONS ON DIGITAL TODAY VS. 25 YEARS AGO

Differences between the digital paradigm shift of the past and the disruptive technology paradigm shift of the future

Despite key similarities, there are major differences between the digital paradigm shift of the last 25 years and the disruptive paradigm shift to come:

Complexity and disjointedness: The technological disruption to come is far more complex than the digital disruption of the past. The digital disruption was driven by one new fundamental infrastructure (the internet), but the coming technological disruption will be driven by multiple, separate infrastructures that work entirely differently. The technologies involved are more complex and abstract, which makes it hard for executives to be confident about the combined impact on their business model. At the same time, these technologies require more expertise and insight on the part of executives.

Impact on a knowledge-based workforce: While the last major wave of digital disruption had an impact on manual workers (reducing need for physical labor, automating labor-intensive processes, etc.), the next wave of technology disruption is likely to impact the knowledge worker. Organizations need to consider the interaction model between knowledge workers and supporting technologies and then assess their hiring needs and how they educate/upskill their existing workforce and processes accordingly.

Ethical and regulatory considerations: Every wave of major disruption will bring about new challenges and considerations for regulators, industries, companies and consumers. While the digital era brought new issues such as net neutrality, online content moderation and consumer protections in digital marketplaces, the new wave of disruptive technologies will force industries to face new questions related to AI ethics, intellectual property infringement, etc.

Part II: The State of Play of Disruptive Technologies in Media

Today, most media firms suffer from the same problems as during the first digital paradigm shift. Namely, they see themselves as innovative firms, whereas most are creative firms. Innovation and creativity are fundamentally different capabilities, yet both are relevant to fostering growth in the context of a paradigm shift.

Disruptive technologies represent the next paradigm shift in media, one that will allow for a wave of new entrepreneurs to enter the media ecosystem and create massive value. The question is how existing firms can benefit. Given how much is in flux at the moment, many executives lack a north star. We interviewed executives from firms of varying sizes and market positions to learn more about how they view the challenges and opportunities that new disruptive technologies represent.

EXHIBIT 3: MEDIA AND ENTERTAINMENT LEADERS’ VIEWS ON DISRUPTIVE TECHNOLOGY

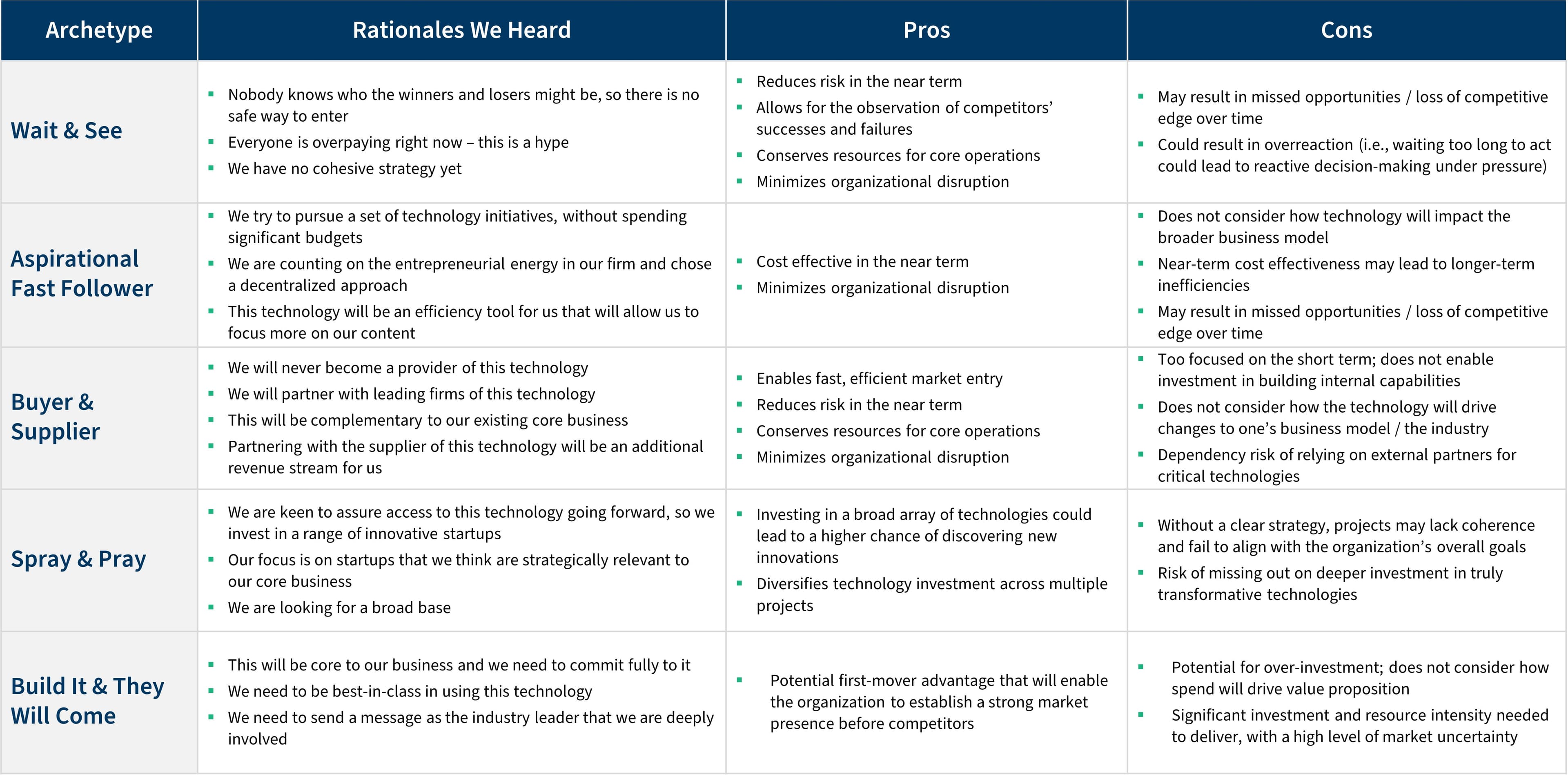

All executives interviewed follow one of five core approach archetypes, which are reminiscent of the approaches that were taken during the earlier transition to digital:

Wait and See: As uncertainty is high, companies wait and see which business cases and technologies have prevailed once the dust has settled.

Aspirational Fast-Follower: Companies take no centralized approach to technological change, but rely on the entrepreneurial spirit of individual business units (“BUs”) to quickly catch up to prevailing trends.

Buyer and Supplier: Companies outsource technological innovation to partnerships, limiting the growth of internal knowledge.

Spray and Pray: Companies pursue a corporate venture-capital approach, hoping some bets turn out to be correct.

Build It and They Will Come: Companies make a strategic bet on technological change, putting it front and center in their business model.

EXHIBIT 4: RATIONALES, ADVANTAGES AND DISADVANTAGES OF THE FIVE APPROACH ARCHETYPES

All of the approaches have pros and cons, but none offer a compelling, cohesive way to prepare for a wave of technology-propelled growth. All of the approaches are too ambiguous about:

How disruptive technologies will impact businesses and the pace of change

The position the firm needs to take

Necessary and justifiable resource allocation

Who is responsible

The art of the possible

Disruptive technologies — specifically AI, blockchain and immersive technologies — are already impacting the media industry as companies start to implement them. In the following section, we highlight our current view on each of the technologies, as well as selected use cases. Our predictions of most likely scenarios are informed by secondary literature. In a second step, we have adjusted use-case impacts and timelines based on expert interviews on the future state of play and our own industry expertise. The direction charted out represents the most likely scenario, but the speed of development and adoption of technologies will depend on resource allocation (e.g., significant future investment in blockchain could accelerate the technology’s development and adoption across industries).

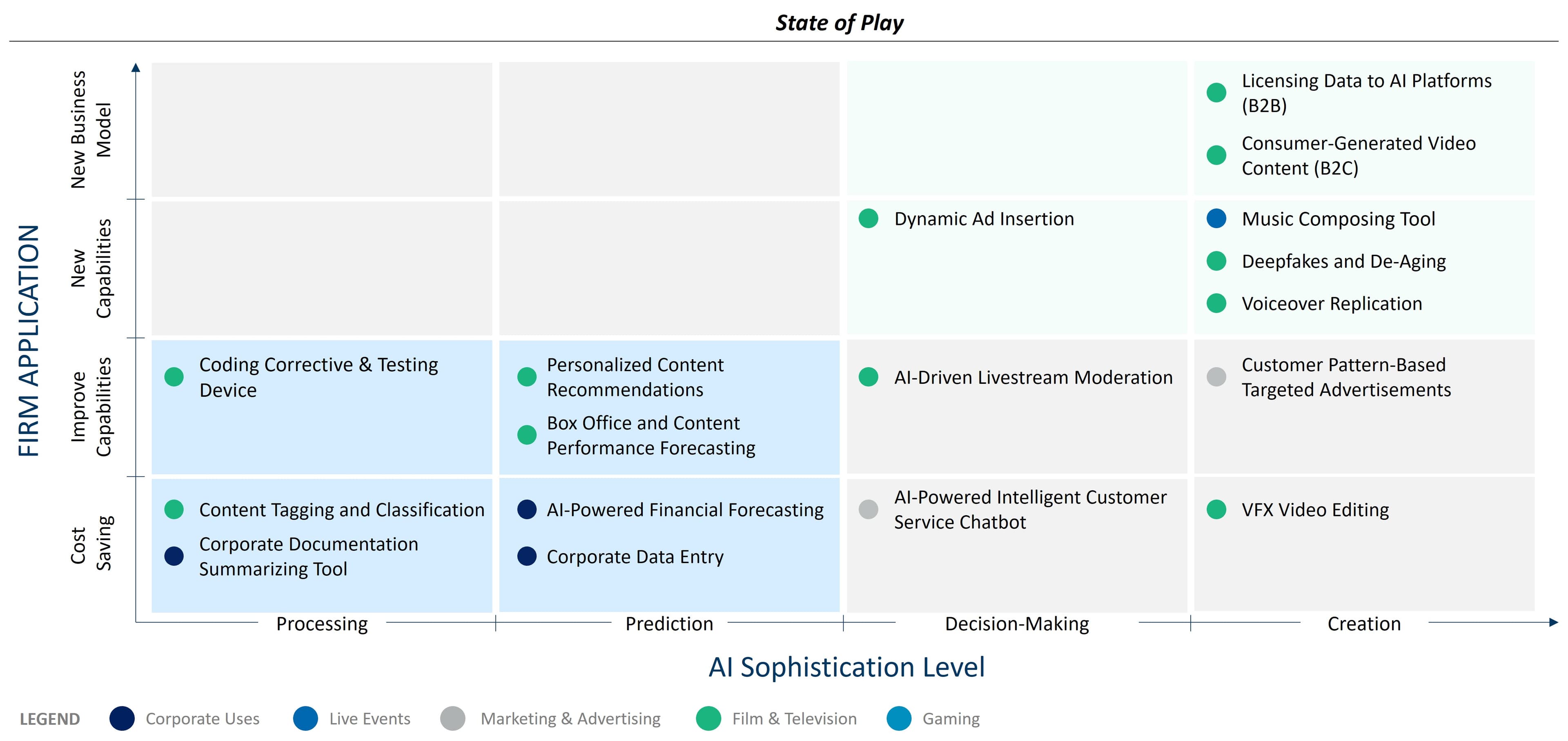

Most activity, in line with many other industries, is focused on AI. Although most AI use cases are currently leveraging unsophisticated technology to reduce costs and incrementally improve existing capabilities, use cases with the potential to transform business models are starting to emerge. As disruption accelerates, it is likely that AI will have a significant impact on business models.

EXHIBIT 5: AI USE CASES ALONG SOPHISTICATION LEVEL AND APPLICATION

AI Overview

In recent months, generative AI has made impressive strides in both effectiveness and industry applicability. AI-generated content is becoming increasingly sophisticated, to the point where distinguishing it from human-made material is progressively more challenging. The above charts illustrate this shift. As the technology matures, we expect more use cases to evolve over time to affect business models.

However, widespread adoption of AI tools in the industry faces significant hurdles, including regulatory frameworks created to limit the use of AI and protect content creators from copyright infringement. In December 2023, for instance, members of the SAGAFTRA actors union ratified a three-year contract regulating the use of actors’ digital images by major Hollywood studios. Additionally, individual jurisdictions are developing their own regulatory frameworks. The potential for AI to revolutionize the industry is clear, but achieving this breakthrough will likely require further technological advancements coupled with a clarified regulatory framework, which the current pace of development suggests will take at least another four years.

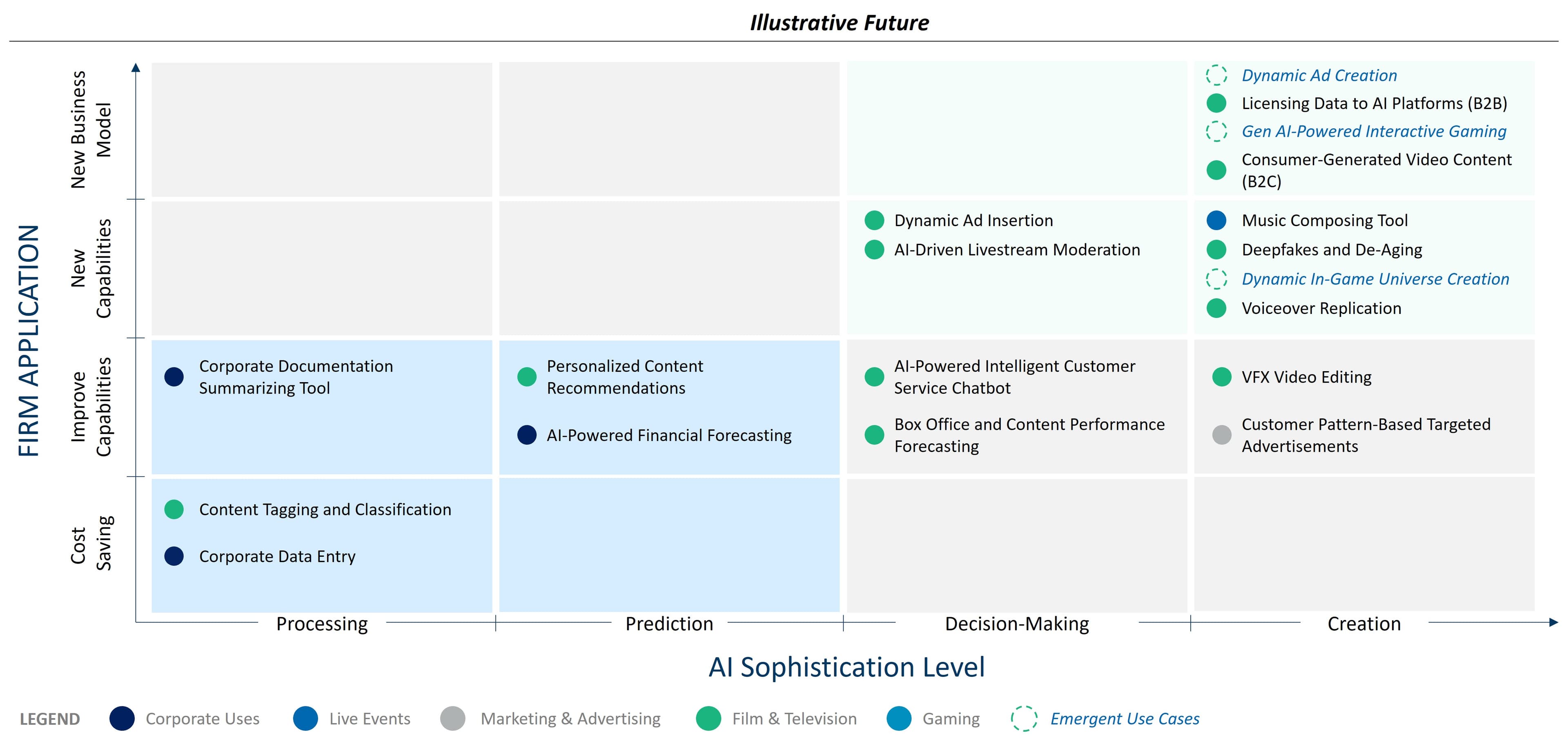

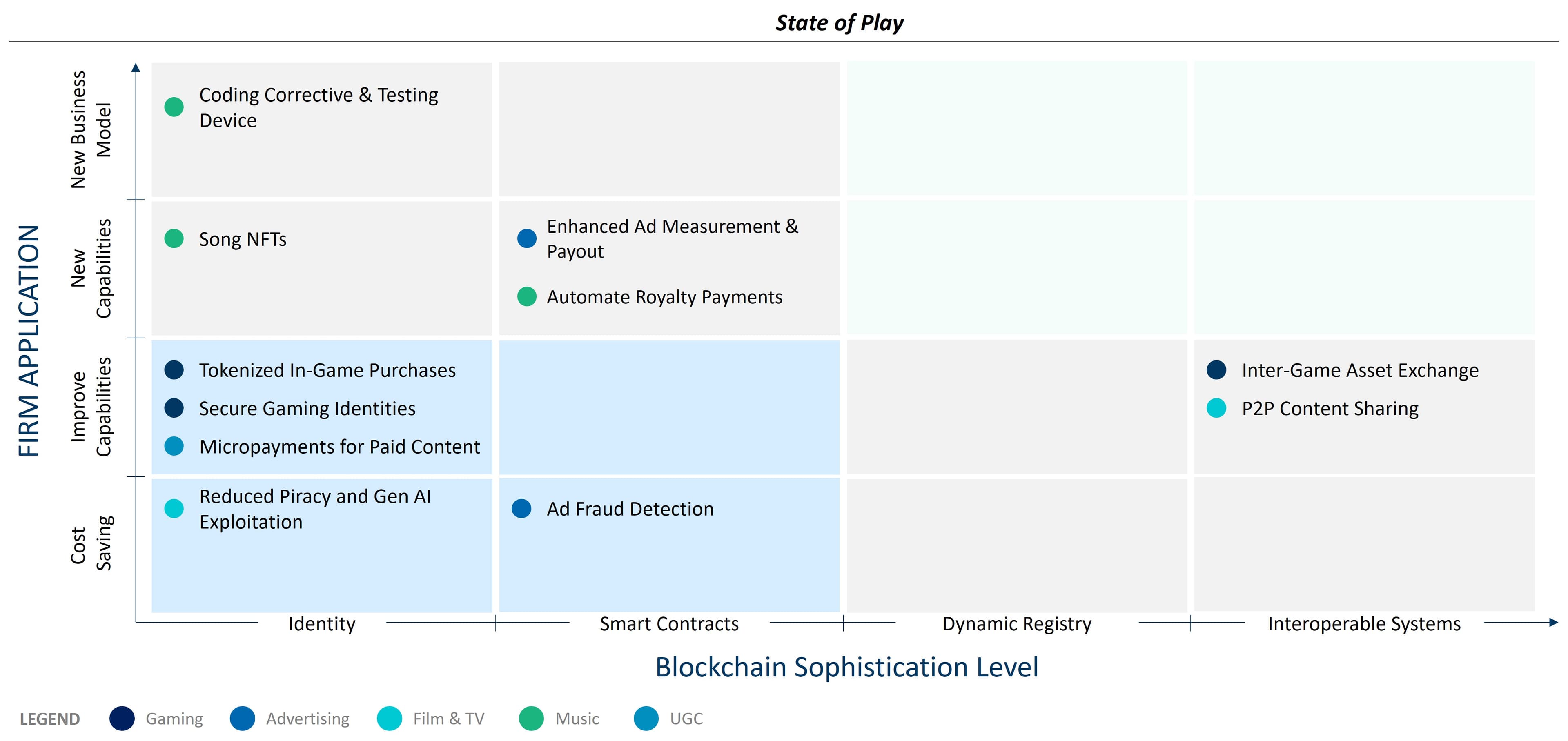

EXHIBIT 6: BLOCKCHAIN USE CASES ALONG SOPHISTICATION LEVEL AND APPLICATION

Blockchain Overview

Although most blockchain use cases today focus on reducing costs and improving current capabilities within media companies, the technology has the potential to drastically alter business models.

Growing adoption of blockchain will facilitate digital ownership and transfer of IP, securitization of digital assets and centralization of digital identities. Economic power is likely to shift from content aggregators to content producers as the collection and dispersion of payments becomes automated through blockchain. Blockchain also provides transparency of transactions to all parties and should reduce the costly diligence efforts around verifying transactions such as music royalty dispersion. Additionally, blockchain can reward media customers by enabling microtransactions without significant repeated transaction costs that would otherwise apply.

As confidence in the technology grows, blockchain platform providers could play a critical role in replacing other intermediaries for advertising payment between brands and channels, with ad measurement and payout becoming automated through smart contracts. As the technology matures, we expect more blockchain use cases to evolve over time to affect business models. This technology primarily has a cost-focused impact at present, but it will become revenue relevant for many media businesses in the future. Given the current state and trajectory of the technology, however, we expect significant revenue impacts no earlier than five to seven years out.

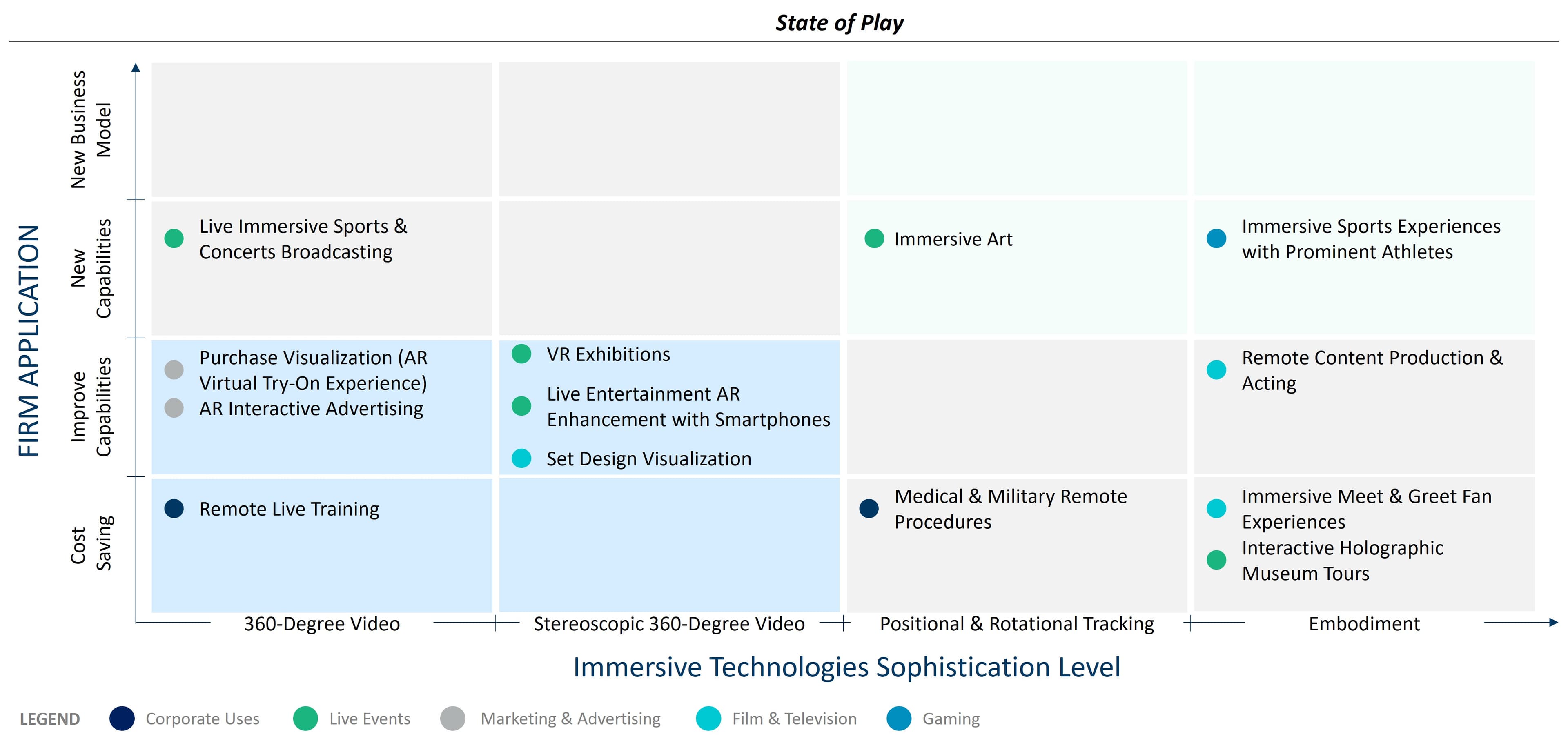

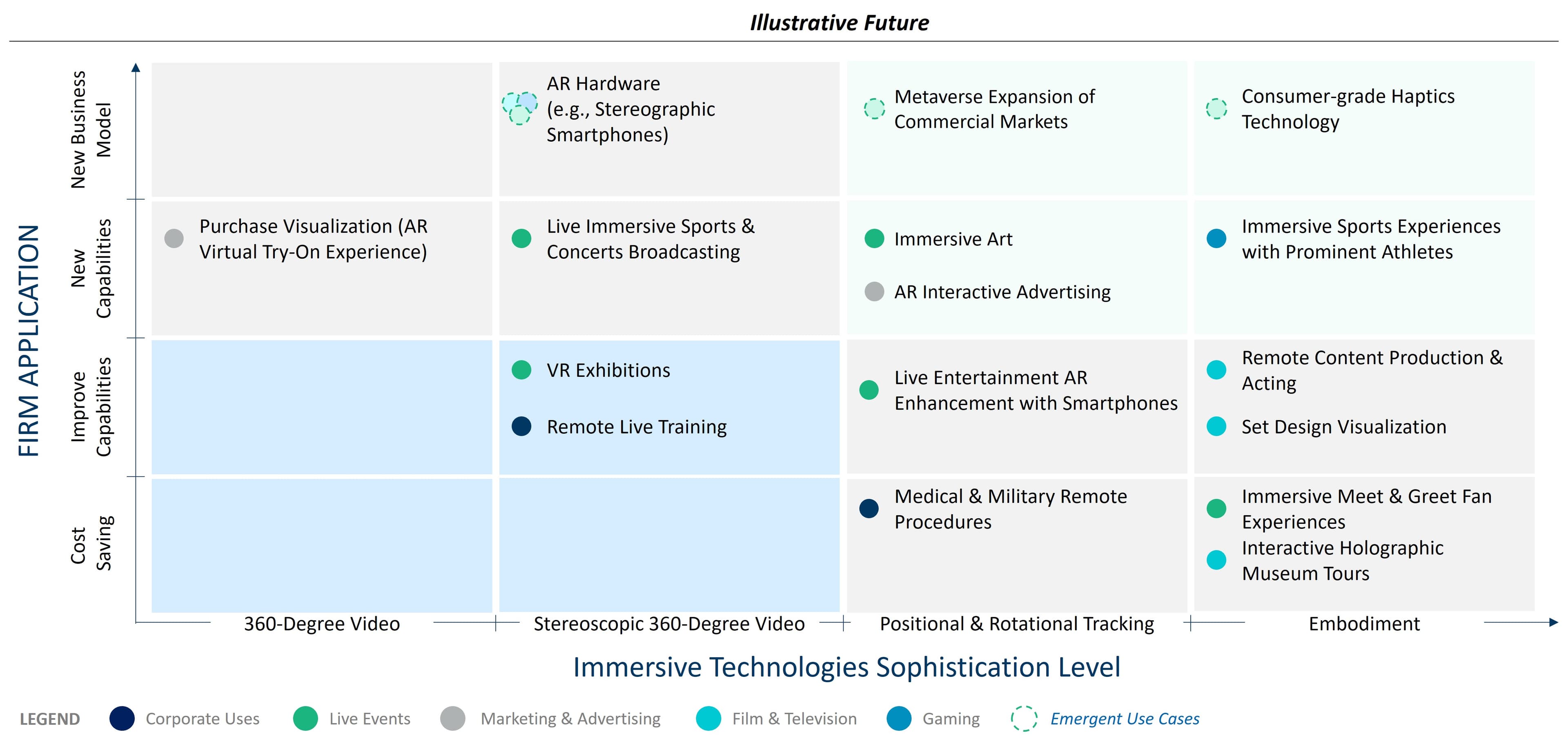

EXHIBIT 7: IMMERSIVE TECHNOLOGIES USE CASES ALONG SOPHISTICATION LEVEL AND APPLICATION

Immersive Technologies Overview

Media is already employing sophisticated immersive technology use cases. However, immersive technology has not revolutionized M&E business models as anticipated in previous hype cycles around virtual reality (“VR”) and the metaverse. This delayed impact can be partially attributed to the limited scope of this disruptive technology. Immersive entertainment directly influences fewer media and entertainment subsegments compared to generative AI, for instance, which currently offers a broader range of revenue-driving and cost-saving applications.

Furthermore, the advanced sophistication of current use cases points to a gap between existing technology and adoption rates. This discrepancy can be attributed to the lack of infrastructure and hardware (e.g., VR headsets) necessary for immersive technology to gain widespread consumer adoption. These technologies require significant behavioral shifts and capital expenditure to generate network effects, such as those in gaming. As the technology matures and infrastructure requirements are met, we expect that more immersive use cases will evolve to affect business models. We estimate that this will take at least another seven to 10 years.

Part III: The Importance of a Company’s Starting Position

The three technologies discussed above are poised to drive expansion of the media value pie for the next two decades. But taking advantage of them will require reimagining products and rethinking business models. Some organizations will need to adopt an ambidextrous approach, described by Harvard Business Review3 as an operation in which structurally distinct yet integrated teams exploit legacy business models while also seeking to monetize and innovate on new technologies.

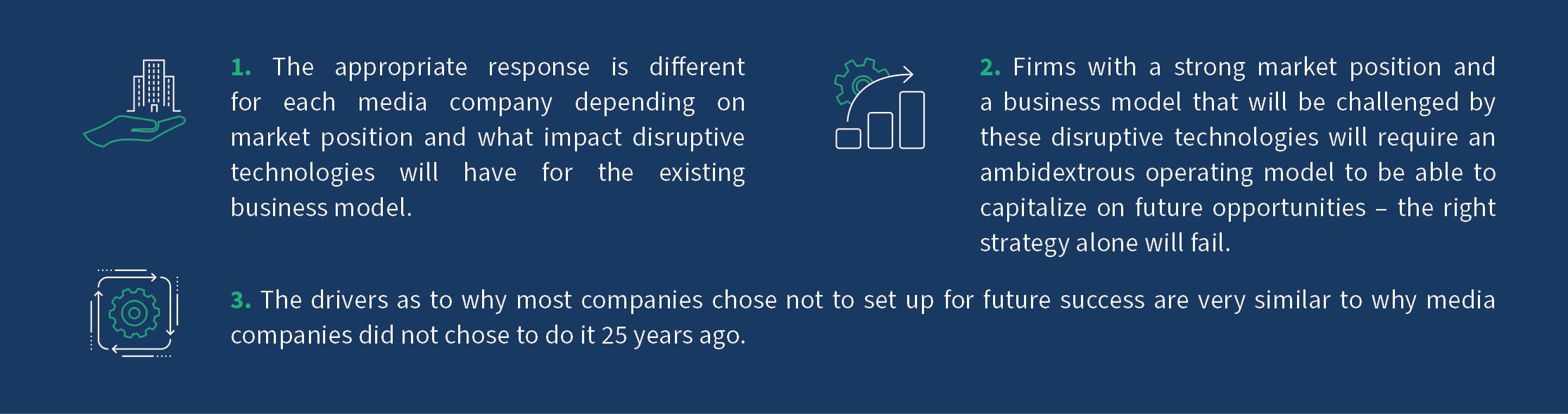

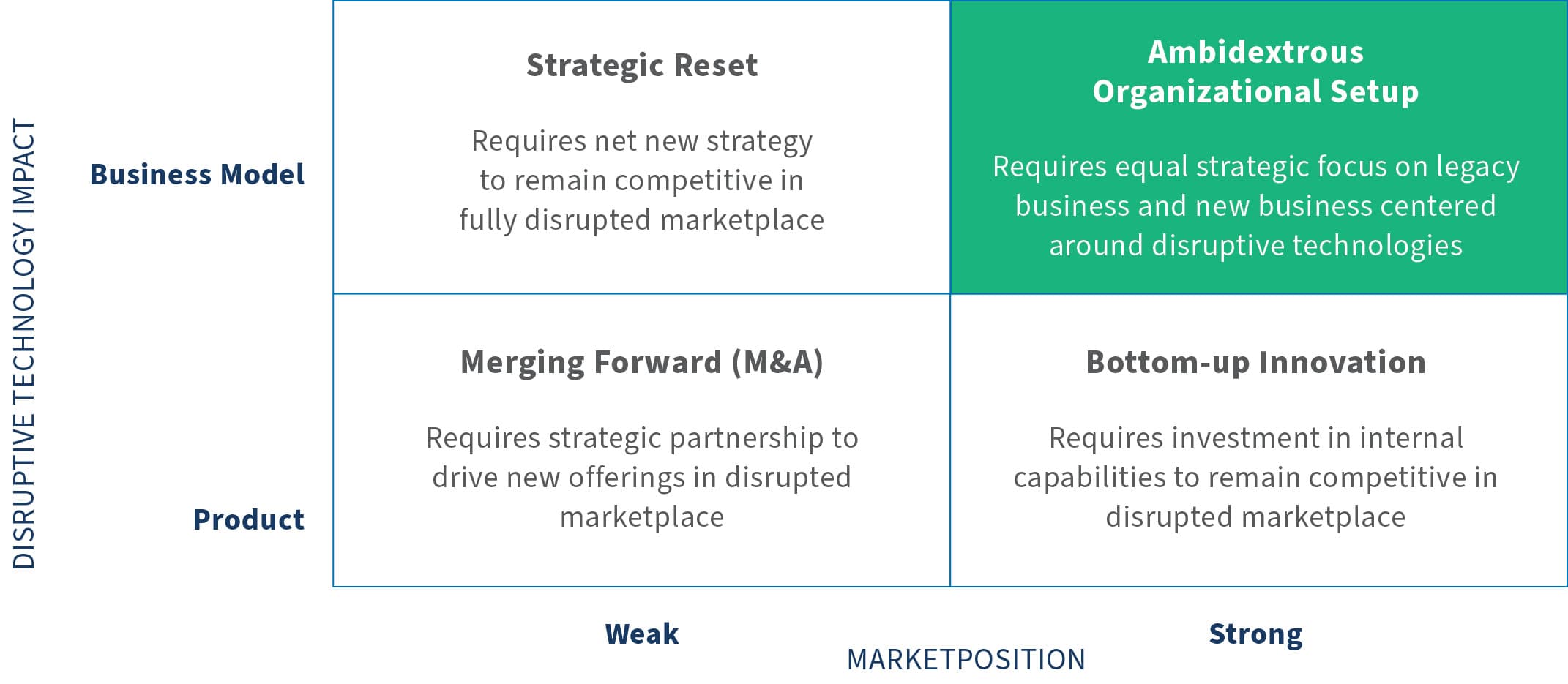

There is no “one-size-fits-all” solution to this challenge. The best course of action for any given firm will depend on its starting position. For example, the best way for a local newspaper to weather the next paradigm shift will differ greatly from that of a leading digital publisher or television incumbent. The approach a firm should take depends on their current market position and the degree to which they expect disruptive technologies to impact their business.

EXHIBIT 8: APPROACHES TO DISRUPTIVE TECHNOLOGY DEPENDING ON DISRUPTIVE TECHNOLOGY IMPACT AND CURRENT MARKET POSITION

For example, if the impact of disruptive technologies is largely limited to the product layer, as it might be if you are a firm in the media supply chain (such as a media asset management (“MAM”) manufacturer) and your market position is strong, you can use your existing product innovation capability to integrate the new disruptive technology into your product. If you do not possess the necessary resources, it may be beneficial to think about merging with another party early, as your own enterprise value will likely deteriorate the longer this decision is postponed.

If, on the other hand, disruptive technologies impact both your product layer and business model (as they could for a television incumbent), you might set up an ambidextrous operating model to explore the new business while also exploiting the current core business.

However, if you lack both the market position and the resources to drive such an operating model in any meaningful way, you might need to approach this paradigm shift as a strategic reset, as it is not immediately clear what direction would yield a superior outcome for shareholders.

Although the advantages of an ambidextrous approach are well known, four key inhibitors keep media firms from applying it in the face of the future disruptive technology paradigm shift:

Product Misapprehension: The media industry is not at the forefront of implementing disruptive technologies. Some companies still largely view them as tools to increase productivity (e.g., AI or blockchain) or new distribution channels (e.g., immersive technologies). Even best-in-class firms often view disruptive technologies in isolation as a product issue and fail to comprehend the future impact on their business model. While this misapprehension explains the often decentralized, low-level innovation approach taken, it sets companies up for failure. An often-cited example of product misapprehension is the case of Nokia. Ultimately, Nokia’s misunderstanding of the smartphone as a product issue resulted in the company’s divesture of its mobile department.

Lifecycle Impact: Many legacy media firms today just underwent a digital transformation which is still fresh in their memory. This significantly diminishes the appetite to transform again in the face of the next paradigm shift, even for those who transitioned to digital with some success. The digital natives that entered the media landscape over the past few decades also have a hard time preparing for disruption, but for different reasons. They still see themselves as the disruptors, despite the fact that many of them are large-scale organizations now. The result is that legacy media businesses and digital native media businesses both face challenges in addressing the coming disruptive technology paradigm shift.

Partnering Mirage: Many media firms are indulging in the thought that they do not have to engage, since they are looking for partners who are sophisticated providers of disruptive technologies. Reliance on such partnerships keeps them from going through the painful and costly exercise of building internal capabilities and organizing accordingly. Partnering on the topic of disruptive technology can be useful, but only in addition to internal capabilities and expertise. In the absence of this internal knowledge, a company exposes itself to the very real danger of engaging in a partnership that, in the long term, mostly benefits the partner. Netflix exemplified this dynamic when it established exclusive licensing windows with several traditional TV networks. Although the networks benefited from short-term cash flows, they contributed to Netflix’s irrecoverable advantage in digital distribution. Today, many firms are following down the same path, for example, in IP licensing agreements.

Funding: Many successful digital native incumbents and media organizations that went through a successful digital transformation operate at significant margins. Generally speaking, the more successful a company is, the less inclined it will be to restructure its operating model to adequately prepare for a coming paradigm shift.

Part IV: Key Principles for a Successful Strategic Response and How to Operationalize

To successfully deal with the next paradigm shift, there are five key principles that companies and their executives must understand:

Take into account the future impacts of disruptive technology: Consider how new technologies will create new business models in your industry, not how to adapt existing business models to leverage them.

Adopt a holistic view of various technologies and their impacts: Companies must be responsive to the impacts of disruptive technologies without merely relying on strategic partnerships. Instead of seeking an external partner to provide add-ons to current models, consider what your future-state organization will look like if you take a holistic approach integrating various new technologies. Media companies must consider themselves technology companies first and foremost. Disruptive technology must be part of your identity.

Ambition should drive your efforts to compete within a new paradigm: Although there are many approaches to innovation, you are most likely to succeed if you adopt a mission-driven model in which leadership seeks buy-in for a new direction. Do not rely on incremental improvements or bottom-up innovation in isolated pockets — this will put your organization at a disadvantage against new entrants.

Make this a CEO agenda issue: The less involved a CEO is in addressing issues arising from disruptive technology, the less likely the company is to succeed. Incorporating disruptive technology must be part of your company’s strategy, not an isolated initiative of a product or technology function.

Adopt a cohesive approach to measuring performance: You cannot succeed without performance management systems that are aligned to support both the legacy and the disruptive businesses. Different definitions of performance are permissible as long as they are different for the right reasons.

Many senior executives struggle to start tackling a problem as wide-ranging and multifaceted as a technological paradigm shift. To help them address such a challenge, we have laid out the following sequence of steps. Although there are certainly other ways to operationalize a successful approach, the below steps are what we consider best practice:

Evangelize: Align on the scale and scope of ambition in the C-suite and the board. Understand your starting position and develop a thorough understanding of the expected magnitude of impact of disruptive technologies on your products and, potentially, your business model. What will be your play? A lack of buy-in on the management team and shareholder levels will likely lead to failure.

Write things down: Develop an executive team manifesto and involve the entire executive team in its development. The manifesto should define the ambition level of the firm and where it wants to be in 10 years. It is important to define the futurestate first in this document, because otherwise the danger of falling into the incrementalist trap is high. Most executive teams will have some disagreement about the right level of ambition, as the uncertainty is high and the velocity of change is even higher. We consider 5%-10% disagreement among senior leadership acceptable and normal for most executive teams; the manifesto is a success if you manage to limit disagreements to approximately this order of magnitude. Include in the manifesto a high-level view on what it will take to achieve the ambition level set forth. Granularity is not required at this stage.

Craft a highly detailed strategy: Deduce nearand mid-term implications based on the strategic direction put forth in the executive team manifesto, and ground the strategy in reality through a detailed understanding of the relevant disruptive technologies. This should include an assessment of the impact of the technologies on the firm’s own business model and the timeline along which the disruption is expected to take place. This is the point when selected senior support resources can be pulled into the fold (e.g., strategy teams or business development), and a rigorous analysis should be conducted on what resources are needed to appropriately leverage disruptive technologies.

Secure resources: Most firms find it very difficult to commit resources long-term. Yet, long-term planning is possible, provided that funding does not start or end based on individual business cycles. Allocate funding and develop a process that ensures funding can be secured regardless of other budget requirements. This process should define how the budget is released in tranches, in line with the progress and learnings of the firm with respect to the future of their product and business model. It is critical for spending to follow learnings — not the other way around.

Distinguish short-term from long-term innovation (and keep it that way): Optimizing the ongoing business is almost always different from defining the business in a new paradigm. That is why conflating the two is a mistake. It is fine to report on short- and long-term innovation concurrently, and to showcase the positive effects of short-term innovation to buy acceptance for the resource allocation to these budgets, as long as they remain structurally separated and are governed by different rules. Structurally conflating the two will almost always result in underfunding longterm innovation after a few budget cycles. A good example of separation is IBM’s Emerging Business Opportunities program, which was created to shield future-growth businesses during the incubation phase and enabled IBM to generate more than $15 billion in growth between 2000 and 2005.

Ask existing leadership to lead long-term innovation: Do not hire externally to lead the new business at first. The long-term innovation business is much more likely to incubate successfully if it is overseen by an established and trusted member of the current executive group. The reason for this is that there will be challenges to the longterm innovation approach no matter how carefully it is planned and how well the procedures are designed. An established executive with good relationships in the firm is much more capable of navigating these unavoidable challenges.

Bring in new talent to scale the new business: After the new business achieves some level of traction and the right external talent becomes interested, it might be time to shift investments in the legacy business to new resources. This might include replacing some of the leadership.

Conclusion

Navigating a paradigm shift as profound as this requires more than ambition—it demands deliberate action, clear prioritization, and a steady hand to manage both immediate needs and long-term opportunities. While these transformations often span 18-24 months, the urgency to make critical decisions begins now. FTI Delta stands ready to support media leaders in charting this complex path, balancing strategic foresight with the operational excellence needed to thrive today while building for tomorrow.

The views expressed herein are those of the author(s) and not necessarily the views of FTI Consulting, Inc., its management, its subsidiaries, its affiliates or its other professionals.

FTI Consulting, Inc., including its subsidiaries and affiliates, is a consulting firm and is not a certified public accounting firm or a law firm.

1 “Perspectives and Insights: Global Entertainment and Media Outlook 2023–2027.” PwC, https://www.pwc.com/gx/en/industries/tmt/media/outlook/insights-and-perspectives.html.

2 Ibid.

3 Charles A. O’Reilly III and Michael L. Tushman (2004): The Ambidextrous Organization. Harvard Business Review. https://hbr.org/2004/04/the-ambidextrous-organization